- Current Account

Current Bank Account for internationals

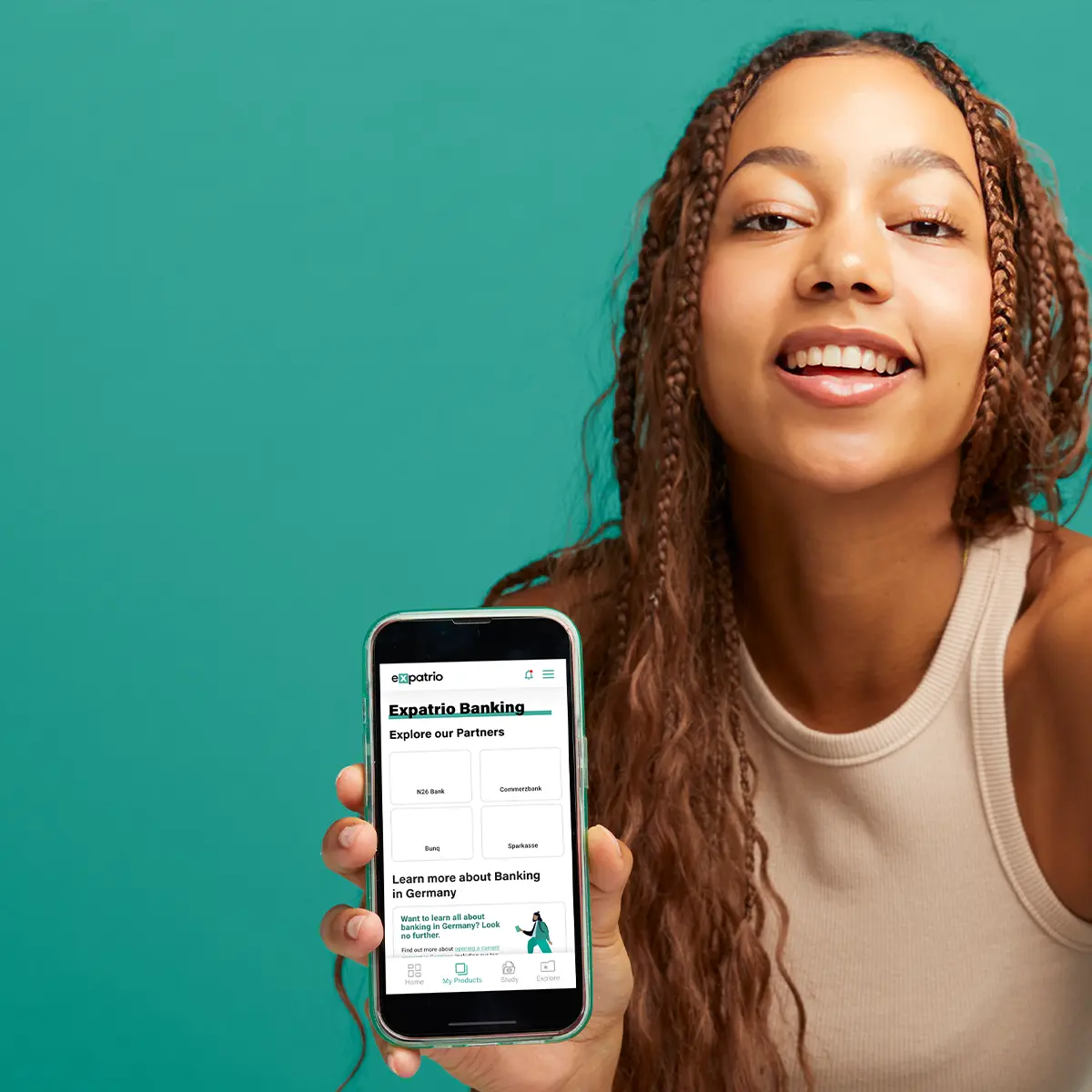

Bank Accounts in Germany

Open a bank account in Germany with our recommendations

-

Get the free Expatrio Bank Account with your Value Package, or choose from other top providers

-

Top-rated options to suit you

-

Mobile and physical bank options

How Our Customers Feel About Our Service

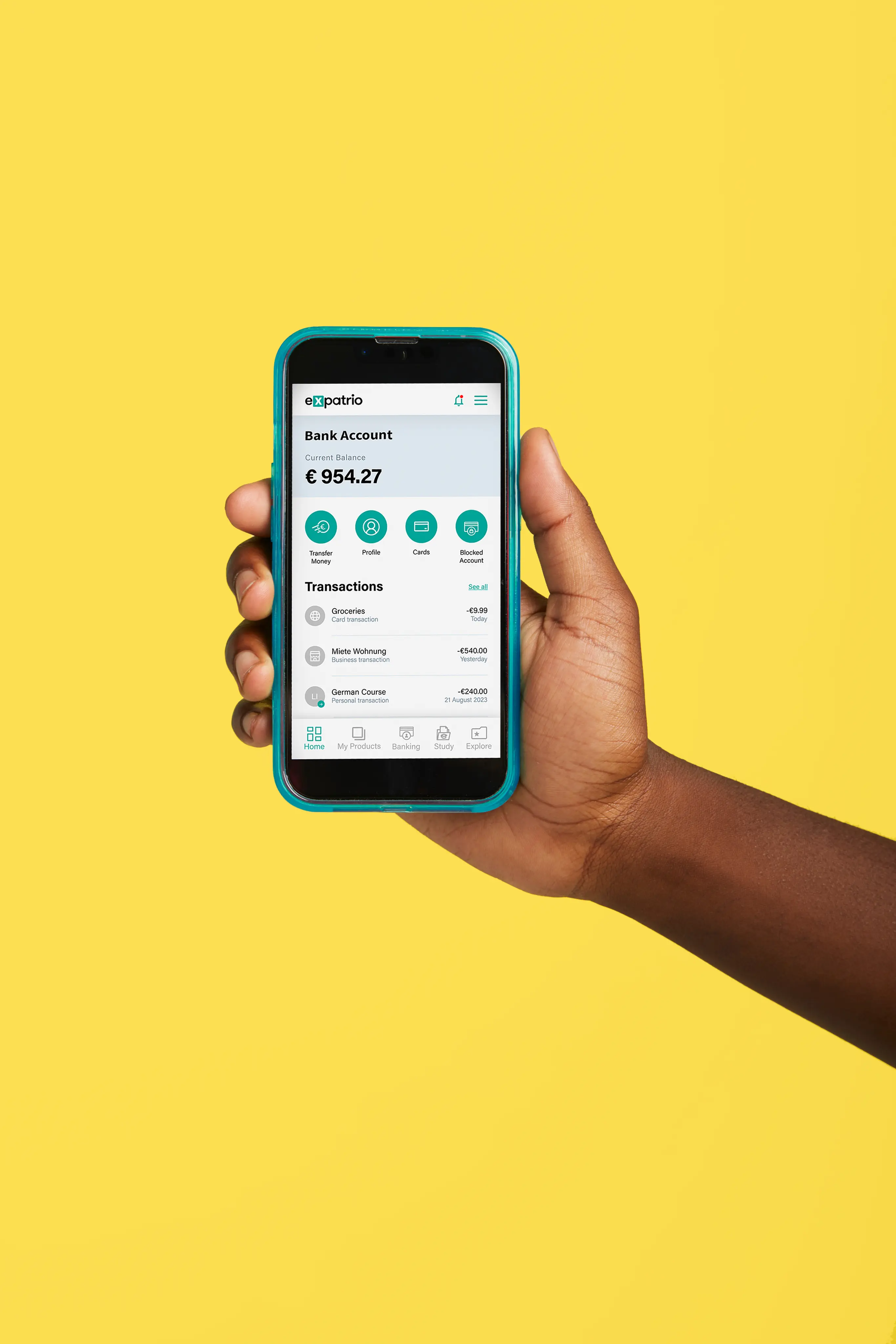

Ready for a banking experience as mobile as you are?

-

3 free ATM withdrawals per month in Germany and the rest of the EU.

-

Once you get to Germany, activate and use your free digital Mastercard. Accepted worldwide.

-

Physical bank card available, for just a small added fee.

-

Manage your money on your terms, anytime, anywhere. Receive your salary, pay in-store, set up direct debits and much more.

-

Get your visa essentials and German Bank Account all at once with the Expatrio Value Package.

Bank account for internationals in Germany

Securing your account should be on top of your arrival-in-Germany list

Opening a German bank account (or Girokonto) is a necessity as soon as you get to the country. You will need a bank account to receive your monthly payouts from your blocked account and to pay for things like your health insurance and daily expenses.

Here at Expatrio, we're all about making things easy for you. We'll help you find the best bank account deals and providers, so your journey is as smooth as can be.

Looking for another provider? Try Commerzbank*!

-

Commerzbank offers the flexibility of physical branches for in-person service and online options for convenient banking from anywhere

-

Commerzbank is a fully licensed German bank meaning you’ll have a German IBAN, simplifying your life in Germany.

-

Commerzbank offers both a Girocard and a debit card. Both of these are used for payments, but a Girocard is unique to Germany and is accepted widely in most shops. Having both options means you have more flexibility in your financial transactions.

Open your Commerzbank* bank account for free now!

What is a Girocard?

Girocard is a German term to describe a type of debit card issued by a bank that is not a credit card but a German particularity. Girocard was previously known as EC-Karte (EC card) or Maestro Card. A Girocard can be pretty useful especially in small cities because several shops and restaurants only accept cash or payments with a Girocard.

On our page about finance and banking in Germany, you can get more insights on Germany's banking system, types of bank accounts in Germany, bank transfers, and much more. You might also want to check our page about international money transfers from abroad to your German Blocked Account or your German bank account.

Have your documents handy

When opening your German bank account, make sure you have all your documents handy. This usually includes your passport, city registration, or other documents supporting your local address. In some cases, you might be asked to provide a copy of your residence permit.

More about German bank accounts

It is important to do your research so you can make a sound decision on which bank you chose for your life in Germany. Read on to learn more about our recommended providers and their bank account offers.

Commerzbank

Commerzbank* is a leading international commercial bank, and it has one of the largest branch networks in Germany. Commerzbank Girokonto is an excellent fit for those aged under 30 who want to open a bank account in a traditional bank.

Their Girokonto has no account fees and you are able to get both a Visa credit card and a Girocard, which you can use in several stores within Germany. Please note that if you receive less than €700 in your account in one month, you will have to pay an account management fee of €9.90 for that month. Commerzbank does not offer English customer support, but you can benefit from customer support either online or in one of their branches.

Wise

Wise was launched in 2011 with the vision of making international money transfers cheap, fair, and simple. t's a quick setup for those new to German banking, and the user-friendly app accommodates speakers of all languages. Wise ensures practicality and efficiency, making it a reliable choice for managing your finances in Germany.

N26

N26 is a fully licensed German bank, offering a German IBAN. No more waiting around or hidden fees – their online application takes just 8 minutes. With N26, you'll have a free bank account, a virtual card, and 24/7 English-speaking support. Their user-friendly mobile app and web version allow you to manage transfers and track spending with ease. Perfect for expats, N26 delivers a straightforward and digital banking solution.

Postbank

Postbank* is a retail banking branch of Deutsche Bank and is a leading provider in Germany. With physical branches as well as mobile banking, it is a great choice for those who are living in Germany.

Bunq

Bunq* is the second largest neobank in the EU, redefining the way you manage your finances. With their mobile-first platform, they offer personal and business accounts, empowering you with real-time payments and multicurrency capabilities. Experience the ease of splitting expenses with friends, setting savings goals, and enjoying virtual debit cards for secure online transactions. Bunq also takes sustainability seriously, allowing you to plant a tree with each €100 spent. Bonus, they also offer German IBANs!

Revolut

Revolut is one of Europe's top digital bank, with over 30million users worldwide. Their goal is for all things money to be accessible to everyone including spending, saving, investing, borrowing, and more.

Open your Revolut account in just a few clicks all via their mobile banking app.

Tomorrow

Tomorrow* is a transparent, digital, and sustainable solution for mobile banking. Real-time payments, a transparent overview of your spending, and a free Visa card are some of the benefits you get with this provider. Tomorrow invests in sustainable projects and contributes to environmental protection projects with every card payment.

Tomorrow Now's sustainable and mobile bank account can be opened in just a few minutes on your smartphone. You can save trees with every single euro spent with your Tomorrow card.

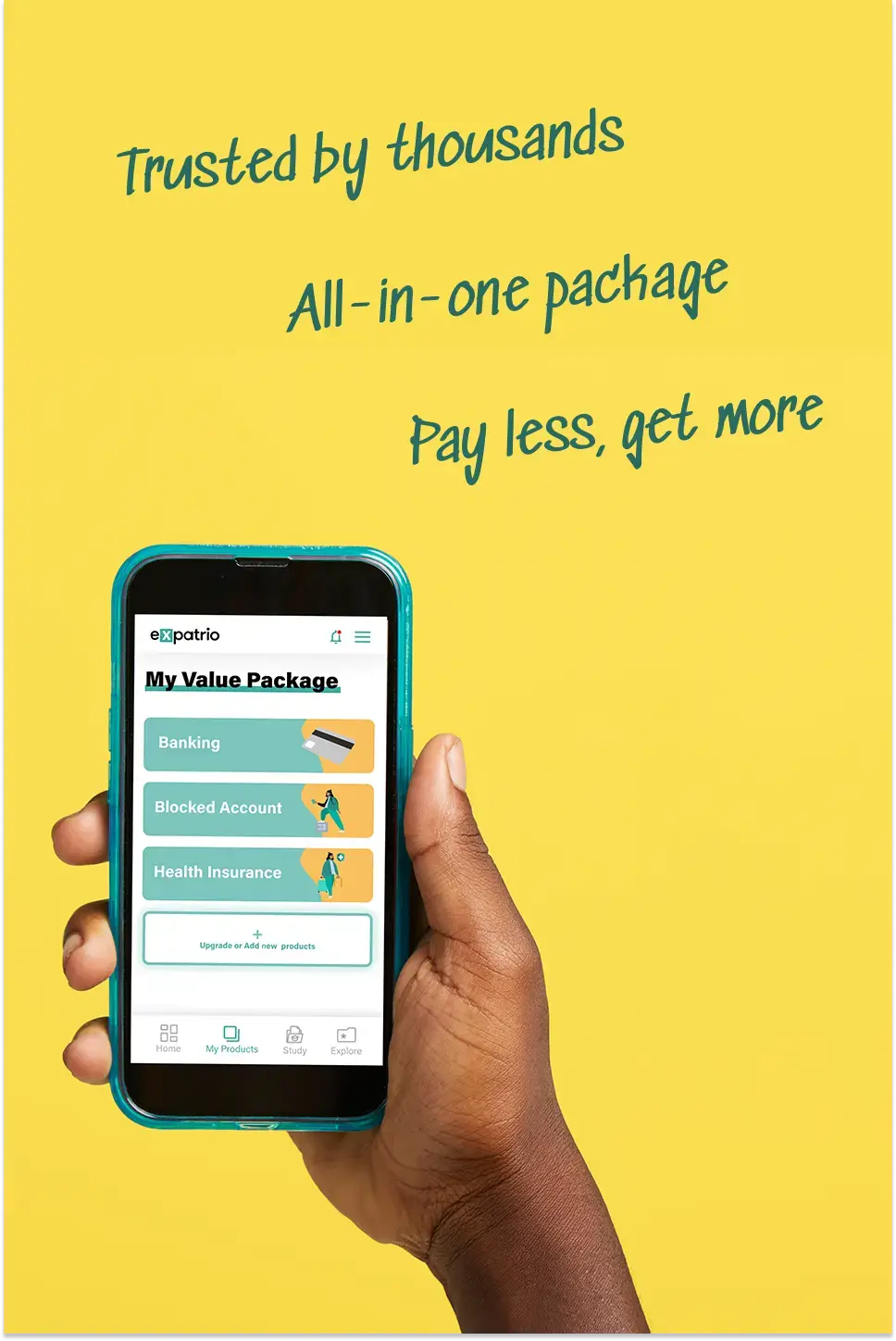

Expatrio Value Package

Simplify your move to Germany with Expatrio's Value Package! Get your mandatory Health Insurance + Blocked Account + free Expatrio Bank Account, and other free benefits!

"Overall, the simple and convenient user experience and reliable service have left a positive impression on me since I started using Expatrio two years ago."

Jiahui Yue

Master's Degree in English Linguistics and Transcultural Studies

Value Package

Your all-inclusive package for an easy start in Germany

-

Blocked Account for only €5 per month (€69 cashback on set up fees).1

-

Up to €90 cashback every year for three years with TK-Flex.2

-

Free Travel Health Insurance for your visa worth up to €953. Accepted worldwide.

-

Germany’s best public health insurance with English-speaking service and bonus program.4

-

Award-winning private health insurance with extensive coverage.4

-

Free digital ISIC access to worldwide discounts (worth up to €18 ).*

How Our Customers Feel About Our Service

FAQs

Do I need a German Bank Account?

You will need a European Bank Account to receive your monthly transfers from your Blocked Account. Your day-to-day Bank Account is different from the Blocked Account. Your Blocked Account can not be used for your day-to-day transactions, nor can it be used for things such as paying rent and other direct debits.

How do you open a Bank Account in Germany?

You can open a Bank Account online with many providers, or in any of the local branches of any German Bank Account.

How can Expatrio help me open a Bank Account for use in Germany?

Our top recommendations include Commerzbank*, Bunq*, N26, Revolut. Customers are free to choose the current bank account that suits their needs.

Which Bank Account should I use to receive my funds from Blocked Account?

You can use any current bank account from a European bank to receive your monthly disbursements from your Blocked Account. Our top recommendation is Commerzbank*

What is a current account?

A current account is a specific type of bank account that is used for day-to.day finances. It is most commonly what people are referring to when they use the term 'bank account'.

It is suitable for daily transactions, direct debits such as rent payments, using ATMs etc.

Free Downloads!

We are here to make everything easier for you.

Find ebooks, reports, checklists, and many more resources to help you with your life in Germany.

*These are affiliate links with advertising intent. We might earn a small commission if you see value in the products and decide to buy them.

Footnotes

[*] With the Value Package, you save the following: €69 cashback on Blocked Account set-up fees + up to €90 TK-Flex cashback + free travel health insurance worth up to €95 + free digital ISIC card worth up to €18. This offer is only valid for customers who apply for the Value Package. Expatrio reserves the right to cancel this promotion at any point in time. Special terms and conditions apply.

[1] Value Package customers can receive their €69 cashback after activating both their Blocked Account and Health Insurance.

[2] TK-Flex is an elective tariff and only available for eligible TK Health Insurance customers. Once the TK membership is activated, TK-Flex can commence. Expatrio will provide the customer with detailed guidelines on how to do this. Within TK-Flex, users have the option to deselect/opt out of services they do not need. In return, there is a cashback bonus of up to €90 per year. However, if the services are needed after all, TK customers can reactivate their Health Insurance coverage by paying a deductible of €24 per service (up to €120) per year. Please refer to our TK-Flex page for more information.

[3] Free Incoming/ Travel Health Insurance coverage for up to 92 days as part of the Value Package for eligible customers worth up to € 95.00.

[4] Focus Money has awarded TK the 'Best Student Health Insurance Fund,' Study Travel Magazine has awarded DR-Walter the 'Super Star Award'', and Kubus has awarded ottonova first place in the service and customer satisfaction categories three times in a row.

[5] Upon opening your Expatrio Bank Account, a valid visa or a valid residence permit will be required in order to maintain access. The timeframe in which you will need to provide these documents will be provided to you.