Once your Blocked Account is open, you can transfer your blocked amount to it. With Flywire (formerly Cohort Go), you can transfer the funds in your local currency if you wish. Find out more here.

Convenient, trustworthy, fully digital

Money-back guarantee in case of visa rejection.

Combine with your Health Insurance in the Value Package.

Fast, secure, affordable. Open online in just a few minutes

Fast, secure, affordable. Open online in just a few minutes

Open a Blocked Account now to secure your German visa.

Coming to Germany for university studies, language courses, preparatory courses (Studienkolleg), job search, and more?

Get your German visa with ease - from fast processing and affordable set-up fees to secure transactions and high customer service standards. Your Blocked Account allows you to prove sufficient financial resources during your stay in Germany.

Forget about tedious German bureaucracy, language barriers, and hidden fees. We simplify the process and do the hard work for you.

NEW: Get your free Expatrio Bank Account automatically connected to your Expatrio Blocked Account.

Send, receive, and manage your money in one place.

The Blocked Account (Sperrkonto) is a special type of bank account required by German law for many internationals to secure their German visa.

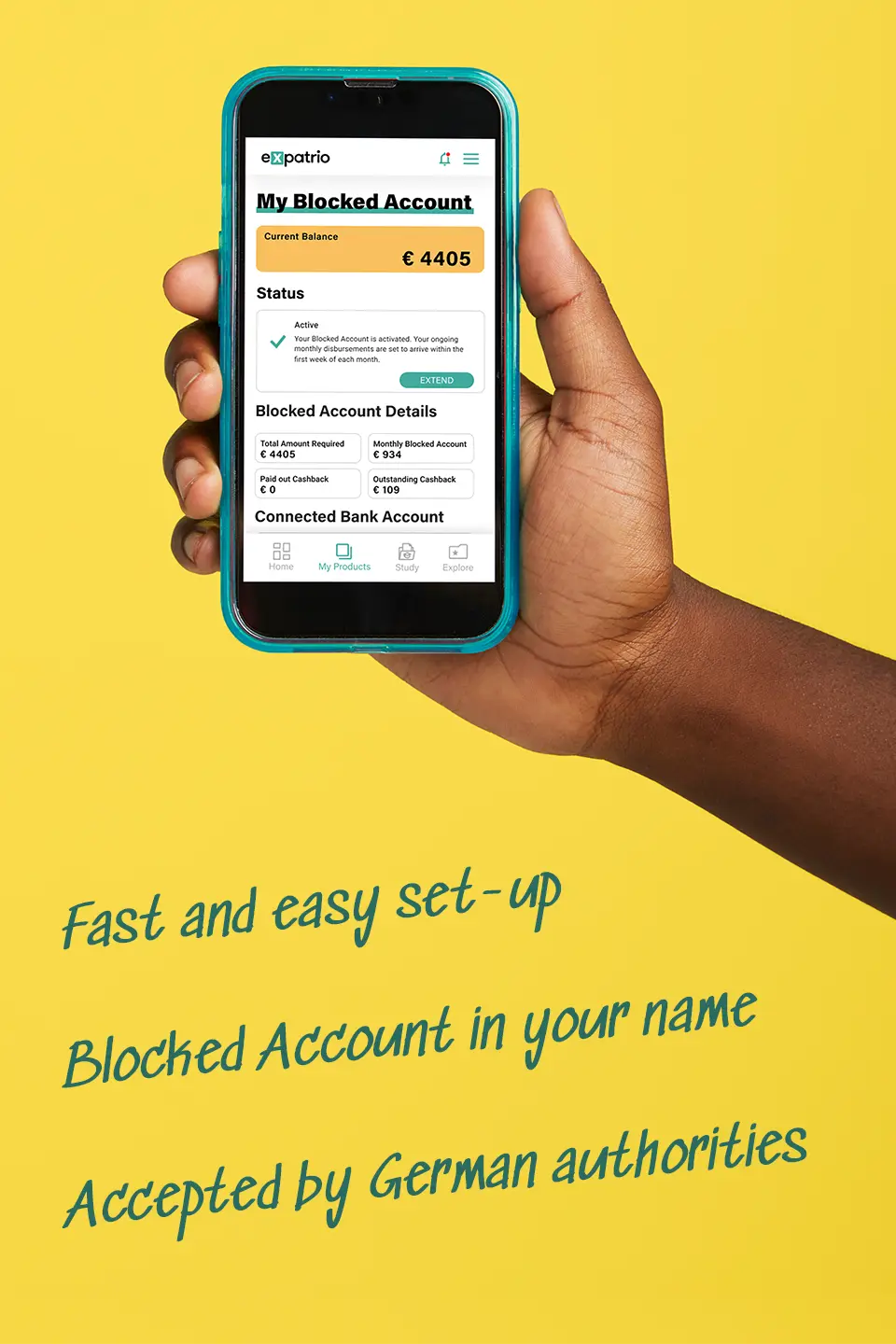

At Expatrio, you can quickly open your Blocked Account entirely online in just a few minutes. Our Blocked Account is accepted by all German authorities worldwide to secure your German visa.

Value Package benefit: Free Travel Health Insurance and German Health Insurance included. Both mandatory for your visa.

Cost Breakdown

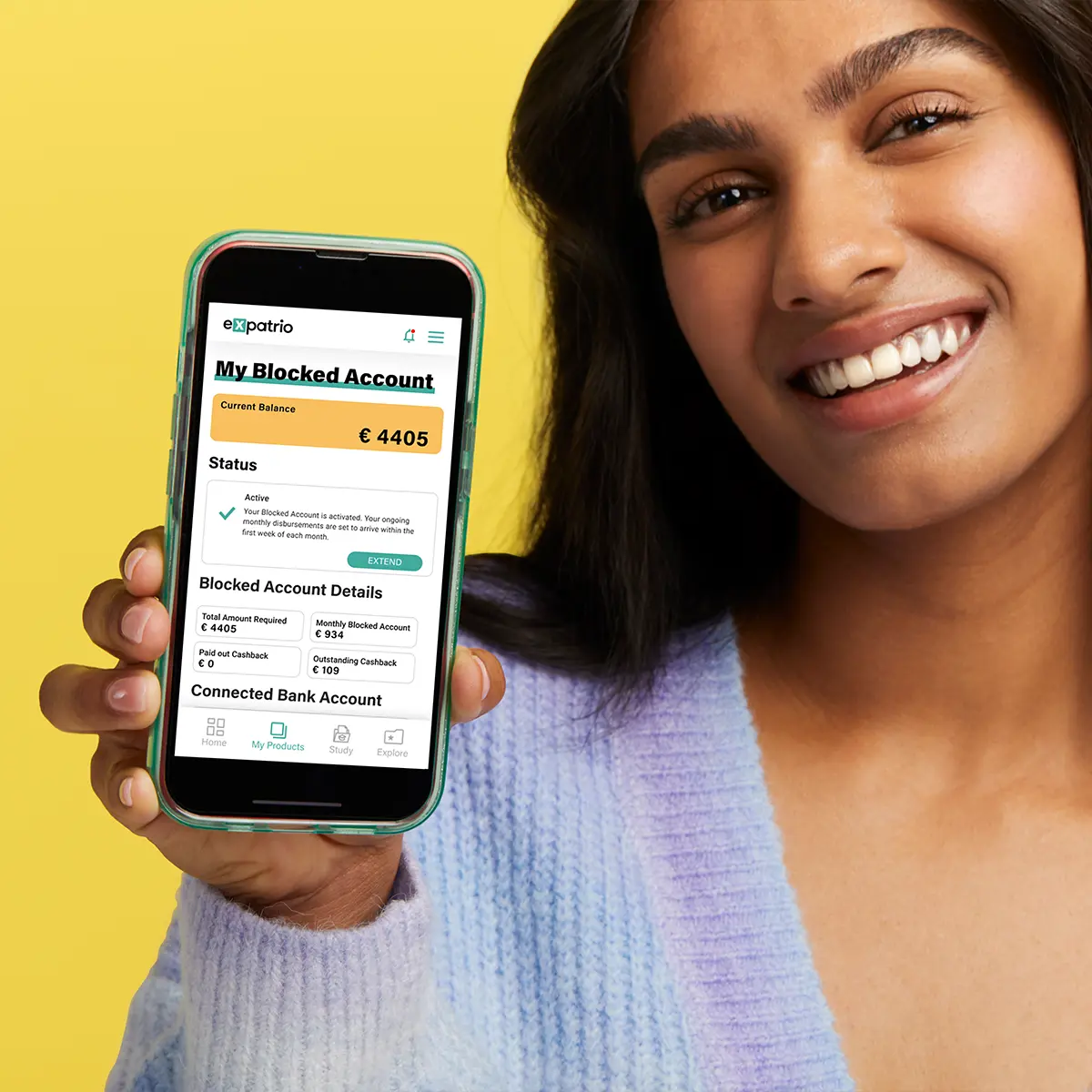

Expatrio’s Blocked Account is one of the fastest ways to secure your proof of sufficient funds for your German visa. Our process is fully online and super simple. On your profile in the Expatrio User Portal, you have easy access to detailed information about your Blocked Account and other Expatrio services.

To open your account, just follow our application flow, and you’ll have your Blocked Account for your time in Germany within a few minutes. Should you have any questions, our Customer Support team is happy to help you throughout your entire journey.

The Value Package makes it simple: you get German Health Insurance plus Free Travel Health Insurance, everything you need for your visa!

Our low monthly and set-up fees allow you to save money for what really matters during your relocation to Germany.

Tip!

Your all-in-one package! Combine your Blocked Account and Health Insurance in the Value Package and receive many benefits like free Travel Health Insurance.3

To minimize high rates when transferring funds from your home country to your Blocked Account in Germany, you have the option of transferring your money in your local currency. You can do this via our Flywire (formerly Cohort Go) payment process.

With Flywire, you can pay in your local currency and with the latest payment methods, like Alipay. Paying in your local currency is usually much faster and more affordable than transferring from a local bank to your Blocked Account in Germany. But don't worry, you can also use the traditional bank transfer option.

Simplify your move to Germany with Expatrio's Value Package. Get your Blocked Account + mandatory Health Insurance + free Expatrio Bank Account, eligibility for The Expatrio Scholarship, and other free benefits.

Fill in our online application form via our secure platform to open your Blocked Account.

Need Health Insurance for your visa? Choose the Value Package to get both at the same time. Easy!

Once your Blocked Account is open, you can transfer your blocked amount to it. With Flywire (formerly Cohort Go), you can transfer the funds in your local currency if you wish. Find out more here.

Once your funds are received, you will get an instant blocking confirmation. Download your Blocked Account confirmation for your visa appointment. This is your 'proof of funds'.

Value Package customers will receive their Health Insurance confirmation documents instantly after succesfully submitting their Value Package application.

Activate your Blocked Account and free German Bank Account via the Expatrio User Portal in one simple process once you arrive in Germany. Your Blocked Account payouts will be automatically deposited to your free German Bank Account with Expatrio every month. No other Bank Account or IBAN is needed!

"With Expatrio, I was able to open a Blocked Account in just a few simple steps. With my Blocked Account in place, I was able to obtain my student visa and make my move."

Parag Nirwan

Master's Degree in Applied Computer Science

Simple account opening in just a few minutes

The current blocked amount set by the German government is €992 per month, for every month of your planned stay in Germany.

Don't worry, for stays more than one year, just set-up a one-year Blocked Account and then you can extend your account as needed.

The money in this account is still your money, however it is used as proof for the German government that you have enough funds to live in Germany,

Blocked amount required by the German authorities

€992*12 months

Initial set-up fee

Monthly fee

Buffer

Returned in full with your last Blocked Account payout (unless some funds were used to cover transfer fees).

Total

Tip!

Your all-in-one solution! Get our Value Package and receive many benefits like free Travel Health Insurance.

Our Blocked Account fully complies with the applicable immigration law.

The Blocked Account is complying with the highest instances and complies with all German authorities’ laws, provisions, treaties, and requirements regarding visa applications and residence permits. Including but is not limited to § 2 (3) Residence Act (AufenthG) and 16.0.8.1 Administrative Order of the Residence Act (VwV-AufenthG). The monthly Blocked Amount is regularly €992 (€11,904 per year), which is specified in the §§ 13 and 13a (1) Federal Training Assistance Act (Bundesausbildungsförderungsgesetzes - BAföG) for students at secondary schools and universities in Germany.

A Blocked Account is a bank account required by the German Authorities as proof of sufficient financial means necessary to receive a German visa. A Blocked Account is essential for international students, language students, au-pairs, job seekers and many people who want to move to Germany. The monthly amount that should be 'blocked' is changed regularly and adjusted to Germany's minimal cost of living. In 2025, the required blocked amount is €992 per month or €11,904 for the whole year.

If you are going to Germany for the long term and need a visa, it is highly likely that you will be asked for a confirmation of your financial resources. To do this, you need to open a Blocked Account and bring the confirmation to the German Authorities in order to apply for the visa.

Expatrio can provide you with instant blocked amount confirmation, once the funds are transferred into your account. This confirmation is accepted by all German authorities worldwide.

Yes, the Blocked Account Expatrio provides is accepted by all German authorities worldwide.

A Blocked Account and a Bank Account are two different types of accounts. You need a Blocked Account to get your German visa, and a Bank Account to manage your money once you're in Germany.

Blocked Account:

A Blocked Account (Sperrkonto) is required to show the German authorities that you have enough money to live in Germany. The money in this account is 'blocked,' meaning you cannot use it until you arrive in Germany. Once you're in Germany, you need a Bank Account to access this money.

Bank Account:

A Bank Account, also called a ‘current account (Girokonto),’ is used for your daily expenses in Germany. You can use it to pay for rent, groceries, health insurance, and more. You’ll get a free digital debit card, and you can also choose to get a physical card if you would like.

When you get to Germany, your monthly payouts will be sent automatically from your Blocked Account to your Bank Account, arriving instantly.

With Expatrio, you get both your Blocked Account and German Bank Account, so you don't need any other German Bank Account.

You can open a Blocked Account with Expatrio in just a few minutes, 100% online.

To do so; go to our webpage, choose Blocked Account, and then go through the questionnaire.

After that, you will be asked to provide some personal information to create a user account. When the account is created and approved, you will be able to access the bank details necessary for the money transfer. When the funds reach your bank account, you will get the confirmation document necessary for your visa application.

The Blocked Account fees paid for Expatrio services are €89 for account setup (one-time fee) and €5 monthly fee. Please take into consideration that together with these fees, you will be asked to transfer the blocked amount required by the German Authorities. This amount varies depending on the length of your expected stay in Germany. An additional €100 buffer is required as it will be used to cover potential transaction fees if such occur. The buffer will be sent back to you together with the last monthly disbursement from your Blocked Account.

You can use any bank or remittance service to transfer the necessary amount to your Blocked Account. Via Flywire you can perform a domestic transfer in your own currency in many countries, making the process faster and less expensive. You also have the possibility of transferring in USD or EUR.

Normally international money transfers take around 3-5 business days, while domestic bank transfers take 2-3 business days. However, in some cases, the process can last up to 14 days. The speed mainly depends on the country from which the money is transferred and the channel which is used for the transaction. When choosing the domestic transfer option (if available), the money transfer usually takes 1-3 business days.

You will immediately receive an automatic email confirmation when the funds arrive in your Blocked Account. This confirmation can be brought to your visa appointment as proof of your financial resources.

From the point in time when you request to activate your Blocked Account by submitting all the necessary documents, it will take us 24 hours to validate them. After the documents are validated, it can take 2-3 business days for the transaction to take place and the money to arrive.

With Expatrio, you get a free German Bank Account alongside your Blocked Account, meaning you will receive your monthly Blocked Account payouts instantly into your Bank Account, also accessible on the Expatrio app.

In case of visa rejection, Expatrio will transfer you back the whole amount from your Blocked Account as well as the service fees.

You will need your:

- passport

- proof of address

- proof of residency

For detailed examples, as well as information about exemptions please visit our dedicated Help Article.

No, with Expatrio you get your Blocked Account and German Bank Account all on one app. You do not need to enter any additional banking details.

Your monthly Blocked Account payouts will be automatically sent to your Bank Account, both accounts are included with Expatrio.

Yes you can transfer more! With Expatrio you have the flexibility to transfer more than your required blocked amount. You can transfer up to €25,000 to your Blocked Account.

Note: Any amount above your official blocked amount will be paid out to you fully, together with your first monthly payout after you activate your Blocked Account.

[1] With the Value Package, you save the following: Up to €90 TK-Flex cashback + free travel health insurance worth up to €95 + free digital ISIC card worth up to €18. This offer is only valid for customers who apply for the Value Package. Expatrio reserves the right to cancel this promotion at any point in time. Special terms and conditions apply.

[2] TK-Flex is an elective tariff and only available for eligible TK Health Insurance customers. Once the TK membership is activated, TK-Flex can commence. Expatrio will provide the customer with detailed guidelines on how to do this. Within TK-Flex, users have the option to deselect/opt out of services they do not need. In return, there is a cashback bonus of up to €90 per year. However, if the services are needed after all, TK customers can reactivate their Health Insurance coverage by paying a deductible of €24 per service (up to €120) per year. Please refer to our TK-Flex page for more information.

[3] Free Incoming/ Travel Health Insurance coverage for up to 92 days as part of the Value Package for eligible customers worth up to € 95.00.

[4] Focus Money has awarded TK the 'Best Student Health Insurance Fund,' Study Travel Magazine has awarded DR-Walter the 'Super Star Award'', and Kubus has awarded ottonova first place in the service and customer satisfaction categories three times in a row.

[5] Upon opening your Expatrio Bank Account, a valid visa or a valid residence permit will be required in order to maintain access. The timeframe in which you will need to provide these documents will be provided to you.